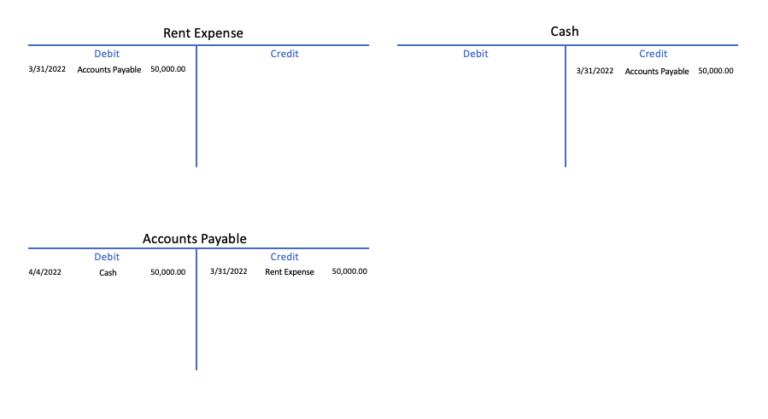

A trial balance is a tool used in accounting to verify that the total value of all debit entries in a company’s general ledger equals the total value of all credit entries. This is an important check to ensure the accuracy and completeness of your company’s financial records. If you have heard of T-Accounts, imagine writing your GL account and draw a “T” below it. Label the left side with “Debit” and the right side with “Credit”. For debit balance accounts, deduct the sum of the debit column to the sum of the credit. Do the same for credit balance accounts.

Here is a step-by-step guide on how to prepare a trial balance from the general ledger report or the T-Accounts activity from above:

Step 1: Prepare a copy of the general ledger report. This is a list of all the entries into the accounts, along with the current balances.

Step 2: Organize your accounts into two categories. Debits category where accounts that have a normal debit balance. This means your assets and expenses accounts. Credits category where accounts that have a normal credit balance. This means the liabilities and equities accounts.

Step 3: For each of your accounts, add up the debit column and add up the credit column.

Step 4: For accounts with normal debit balance, deduct the debit total of the account with the credit total of the account. If this resulted in a negative balance, this means that there is an incorrect accounting transaction or entry.

Step 5: Compare your debit and credit totals to ensure that they are equal. If the totals are not equal, there may be an error in the accounting records. (Assets = Liabilities and Equities)

Step 6: Review your trial balance to ensure that it accurately reflects the balances in the general ledger.

It is important to note that a trial balance is not a financial statement, but rather a tool used to verify the accuracy of the accounting records. After preparing the trial balance, the next step in the accounting process is to prepare financial statements, such as the balance sheet and income statement.

Oojeema accounting software automatically prepares your trial balance report based on the general ledger report. This allows you to save time.